Starting 1 April the Czech National Bank regulates mortgages with higher LTV ratio. In practise it means that the banks could provide to the new clients mortgages only up to 90% of a purchase price, resp. a pledge value.

Blog

Read our Blog with more than 90+ posts

We offen receive questions regarding the tax system in the Czech Republic. Find below the general overview of the taxes that might interest you if you would like to own a property here:

On 1 December 2016 new Act started which has also impact on mortgages for foreigners. Here is a brief overview:

Starting 1 November 2016 the new Act related to the Real Estate Transfer Tax became into force. Before this date a seller and a buyer were abble to agree who will pay the tax for the transfer.

Many changes on the Czech mortgage market are coming this autumn:

Historically low interest rates!

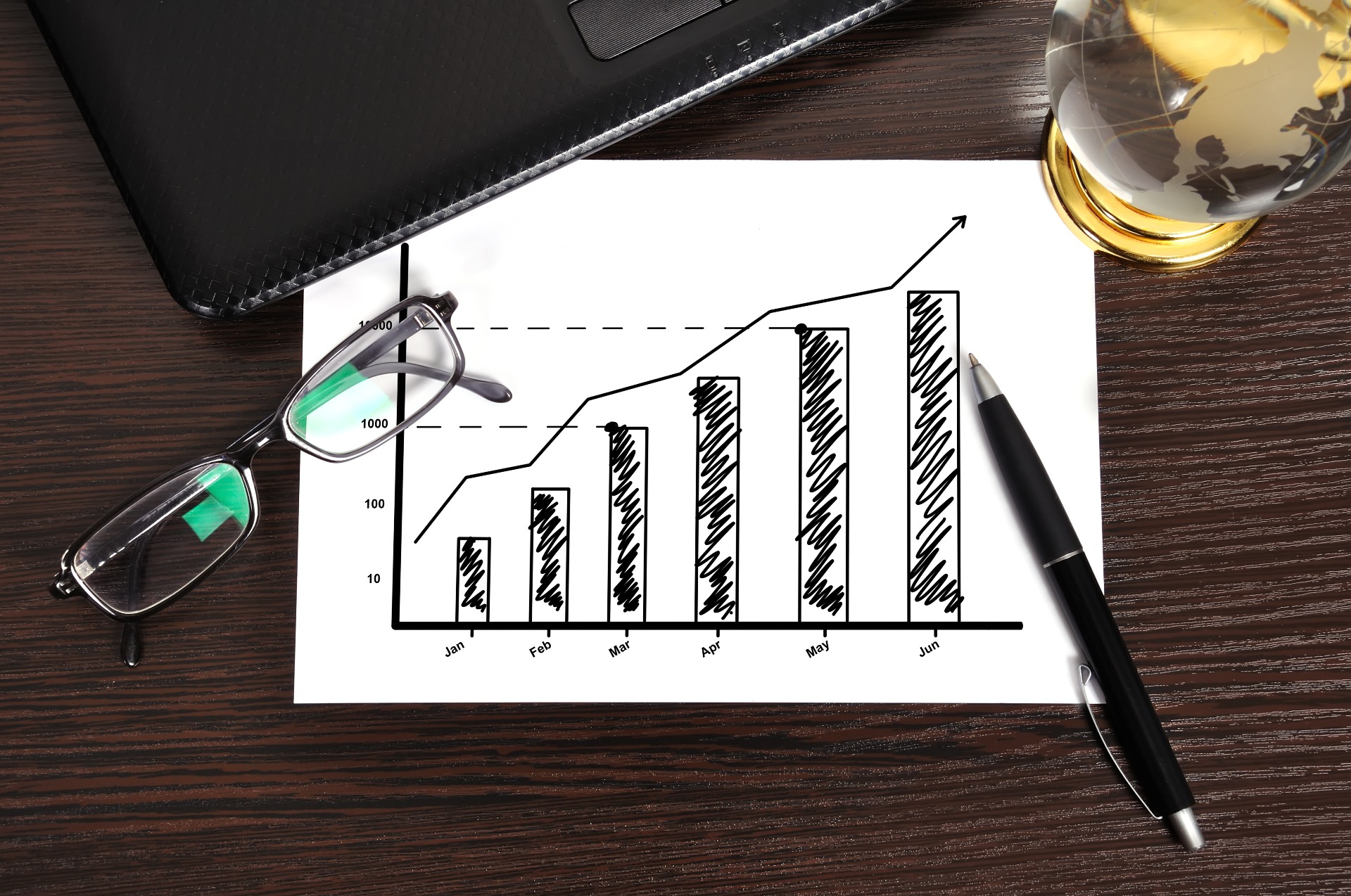

Based on the FINCENTRUM HYPOINDEX (https://www.hypoindex.cz) the average interest rate of mortgage loans decreased to 1.84% p.a. in August 2016 in the Czech Republic. The decreasing trend continues to historically low interest rates!

Coming changes of the Czech mortgage market

The Czech National Bank ("CNB") wil influence the maximum LTV (Loan to value) of the mortgages. The CNB recommends max 95% LTV from 1 October 2016 and max. 90% LTV from 1 April 2017. The true is, that this is only the recommendation, but the banks which will provide loans above this max. LTV settled by the CNB will need...

The interest rates of the mortgages are recordly low, because Czech banks have still attractive spring campaigns. This month is the best to take a mortgage for a variety of reasons.

Many banks which provide mortgages in the Czech Republic started spring campaigns last week. The campaigns are different, but with the same result for the clients: you will save money now.

Czech mortgage market in 2016

If you were not able to find your dream property during the last year, where the interest rates of mortgages were extremely low in the Czech Republic, you will have another chance for a great conditions in 2016.