As of early 2026, investors in the Czech real estate market will need to revisit their strategies. The Czech National Bank (CNB) has introduced stricter lending standards for mortgages used to finance investment-property purchases — and any mortgage taken to acquire a third property is now automatically classified as an "investment mortgage."...

Blog

Read our Blog with more than 90+ posts

Why Acting Now Makes a Real Difference

Mortgage Rates in Central and Eastern Europe: An Opportunity or a Challenge for the Czech Market?

Over the past few years, mortgage markets across Central and Eastern Europe (CEE) have gone through dynamic changes driven by inflation, monetary tightening, and evolving regulatory frameworks. As interest rates start to stabilize, many investors and borrowers are asking: How does the Czech market compare with its regional peers, and what can we...

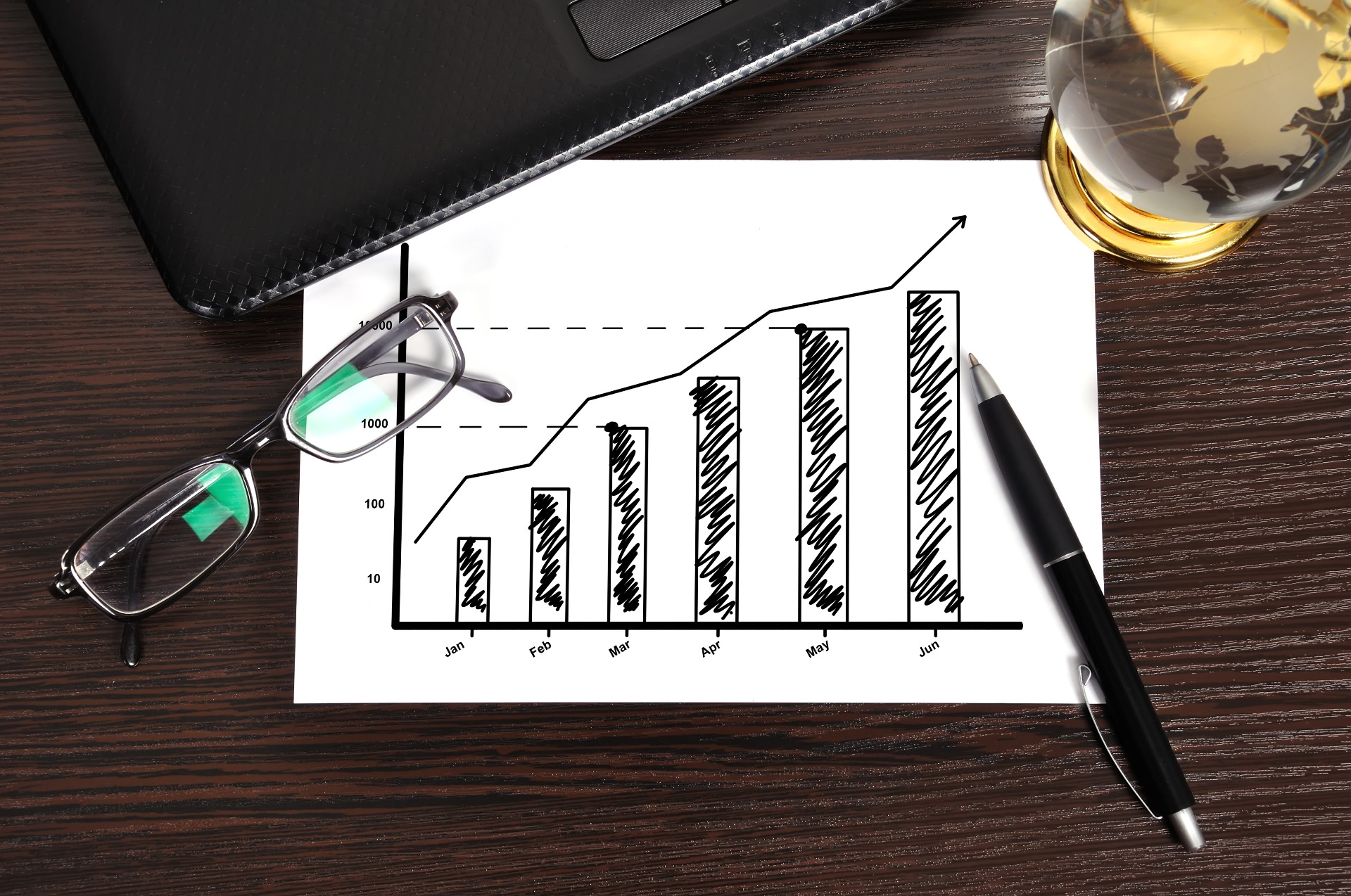

The Czech mortgage market continues to evolve rapidly, with 2025 shaping up to be a pivotal year for borrowers and lenders alike. Recent data highlights several important trends and regulatory updates that both current homeowners and prospective buyers should be aware of.

Owning a family house is a dream for many: offering space, privacy, and long-term value. But building a house from scratch can be a complex journey full of planning, paperwork, and financial decisions. Whether you're a Czech national or an expat living here, this guide will walk you through the essential steps and financing options when building...

This month marks a major milestone for us at MortgageSpecialist.cz – we're celebrating our 10-Year Anniversary!

Being your own boss comes with freedom, but it can also make getting a mortgage in the Czech Republic feel like a challenge. If you're self-employed, a freelancer, or running a small business, you may have already heard that Czech banks can be stricter when it comes to approving mortgage applications from non-salaried clients.

Buying a home in the Czech Republic is an exciting journey, but it can also feel overwhelming—especially for expats unfamiliar with the local market, regulations, and language. At Mortgage Specialist, we offer a full-service solution to guide you through every step of your home purchase, ensuring a smooth and stress-free experience.

Current data from the Czech mortgage market

The Czech mortgage market has shown notable stability in recent months, offering a valuable opportunity for prospective borrowers to assess their options. Below, we provide a comprehensive overview of current trends and key data points shaping the market.

When the interest rates of the mortgages were at the level of 2% p.a. there were plenty of clients who took the mortgage even they did not need. Mostly the clients said that they can invest their own savings and get a significantly higher return than 2% so why they should use their own money for buying a...